This post may contain affiliate links. You can read my affiliate policy here.

Have you ever been at your desk fantasising about doing something completely different? Looking out the window wishing you were a gardener, a part-time tour guide, or a seasonal skiing instructor? But you know that this will never happen, because you will continue your career until you retire. Unless you take a soft retirement that is.

What if instead of continuing to work until you drop (or hopefully retire) you could slow down, knowing you have the money to retire fully when the time comes, but not to having to continue to make your current salary until then? What if instead you could do a part time or lower paying job that you do more for pleasure than for profit?

What is Soft Retirement?

There is no official definition of soft retirement, but it is used to describe a state of semi-retirement. A time before full retirement where someone steps away from their current career, usually to pursue a passion, a different kind of work and/or work significantly lower hours but is still making an income.

The key here is that even though the person is stepping off their previous career path and most likely makes significantly less money, they can still live a lifestyle they are happy with, and still have the opportunity to fully retire later in life.

Anyone can take a soft retirement, independent of age and income, but it does require some money in the bank. The million-dollar question however is How much money do I need for a soft retirement?

How Much Money Do I Need for Soft a Retirement?

There is no exact amount of money that signals that you can take a soft retirement. Instead, it depends on your lifestyle and expenses and how much money you would make during your soft retirement.

Let’s explore the financial principles behind retirement better understand these different parameters:

How Much Money Do I need to Fully Retire?

Common perception is that you need between half and two thirds of your final salary to maintain your current lifestyle after retirement. The thinking is that you will no longer need to save for retirement, commute, or by work related clothes etc. that you did when you were working.

Which? Magazine has explored if this is true among current retirees and noticed that how much people spend is actually more related to their lifestyle and expenses than to their previous salary. Which make sense! If you want to travel the world in luxury you will need a lot more money. If you prefer to live a simple life in a less expensive part of the country you need less. No matter what income you had before you retired.

Statistics can be a good guide and an interesting read but to know how much money you need we need to consider your lifestyle and expenses. Consider the following:

- How much do I spend each year?

- Would I need less money for anything when I retire? (No commute, kids no longer living at home, mortgage paid off etc.)

- Would I spend more money on anything when I retire (holidays, eating out….)

Calculating Your Retirement Nest Egg

Considering the above should give you an idea for what amount you might need when you retire. Here, we will use £20 000 and £40 000 a year as examples. This depends on your lifestyle though, and your number may be significantly higher or lower.

The rule of thumb when it comes to retirement is that we need 25 times our annual expenses to not risk running out of money. This assumes that our money are invested in a good mix of stocks and bonds (rather than having them in a savings account).

This means that if you want to have £40 000 to spend annually you need a nest egg of £1 000 000. If instead you will be happy with £20 000 a year £500 000 is enough. But that is still a lot of money!

£40 000 x 25 = £1 000 000

£20 000 x 25 = £500 000

Good thing we have compound interest on our side.

Read More: How Much Should You have Saved for Retirement at Your Age?

Read More: Easy Investing for Beginners: How to Empower Yourself Financially

Coaststing to Retirement (Coast FI)

Compound Interest and Retirement Investments

How much our money will grow depends on:

- How they are invested.

- What the market is doing.

- How much inflation there is.

However, looking at historical data (which is not a promise for the future but the best information we have) a good long-term average to use, excluding inflation, is an annual growth rate of 6%.

10 years global stock market returns have average 9.2% over the past 140 years.; accounting for a 3% inflation, 6% is a good, slightly conservative, number.

Because compound interest (interest on interest) becomes a great force over time. In fact, if your money is invested with a 6% return, they double every 12 years! Therefore, how much you need to have invested today, in order to be able to retire without ever saving another penny will depend on:

- What will be your annual spending in retirement?

- How many years do you have until you plan to retire?

How Much Money Do YOU Need?

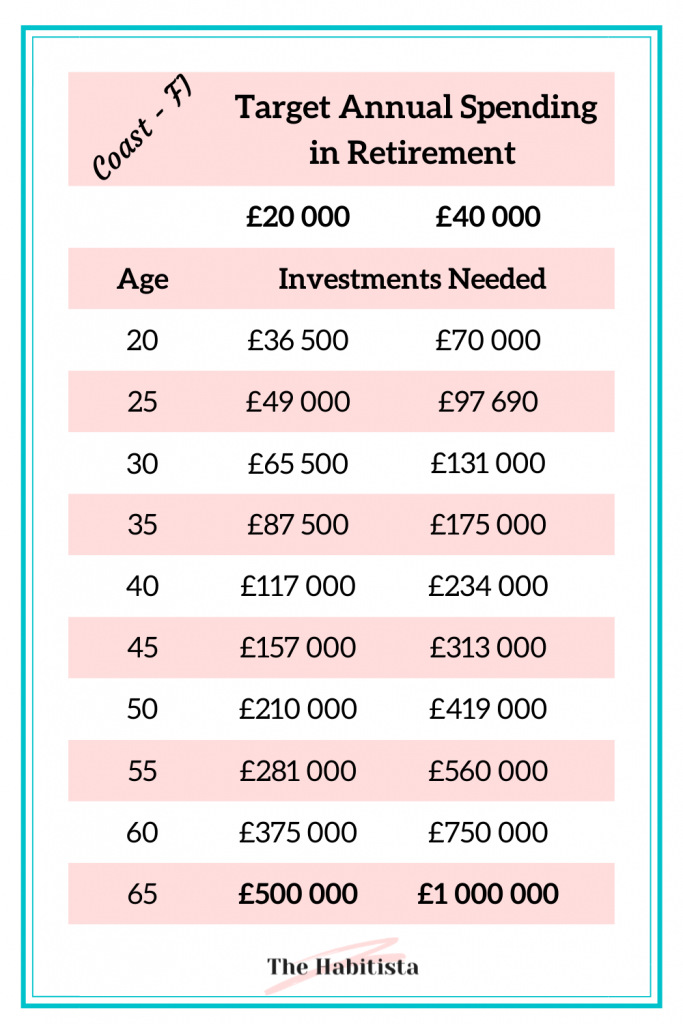

Let’s take a look at how much you need to have saved at different ages. If you plan on retiring at 65, with a retirement spending of £20 000 and £40 000 respectively.

As you can see from the table, if your target is to retire with £20 000 a year, and you are 35 years old, you need £87 500. If you have this money invested in your retirement (or other) accounts, you don’t need to save anything more in order to retire at 65. That’s it. You’re done. You can site back, let compound interest work for you and never save another penny. And still be able to retire as planned.

If you are targeting £40 000 a year however, you would need £175 000 at the age of 35 and £234 000 at age 40 to be able to retire at 65 without saving another penny.

In financial independence circles, this is known as Coast Financial Independence (Coast FI) as you can coast from this point onward, just making sure you can cover your expenses. And you will still be (more than) ok.

Read More: Financial Independence for Women: 7 Steps to Financial Empowerment

Coast FI and Soft Retirement

Becoming Coast FI is the first step towards a soft retirement. It means that you no longer need to make extra money to save (unless you decide on a more extravagant retirement) but you still need to cover your expenses until you’re 65.

If I’m Coast FI, can I take a soft retirement now?

Soft Retirement When You Earn More Than You Spend

That depends on your expenses. If you are living a very low cost of living life, you might be ready now! If you for example own your own home without a mortgage and won’t need any large transport cost in your soft retirement, then maybe you can pull the plug now.

You will want a bit of a financial cushion to soften the landing if you don’t have your soft retirement income lined up yet, but you can feel completely free to do anything you want that covers your ongoing expenses.

Do you want to pot around in a garden centre? Do shifts in a posh clothes store (and get the employee discount?!?)? Be a tour guide? The sky is the limit – as long as your expenses are covered. And who knows, you may end up finding a passion that makes more income than you ever imagine when you let yourself try!

Soft Retirement When You Have Higher Expenses

If your expenses are still high however, you may want more of a financial cushion before pulling the plug on your current career. How much depends on:

- Your expenses.

- How much you are ready to earn in your soft retirement.

- How long you have to retirement.

Let’s say that my expenses are £40 000 per year and I expect them to be the same in retirement:

First, if I’m 40 years old I should have £234 00 invested (be Coast FI) before I consider soft retirement.

Next, I need to be able to cover my expenses for the next 25 years (until I’m 65 and access my pension). If I want to continue to live on £40 000 a year, I need to either be happy taking soft retirement in a way that gives that kind of income. For some, that can be fairly easily done by reducing hours or work on a consultancy basis. For others, it can feel almost impossible!

If you are currently earning very close to the amount you spend each year, you can still consider a career change if you’re not happy with what you’re currently dong, but to actually take a soft retirement you probably need quite a lot more saved up. Or find ways to reduce your expenses.

When to Take Soft Retirement

A soft retirement isn’t for everyone, but it’s a great option to have. You may love your career now, but we never know what the future holds. We may get tired or unwell, the industry we work in may change or we may just have enough, plain and simple.

When you have your finances in order and know that soft retirement is an option for you, really truly consider it. Is there anything you wanted to do in life that you haven’t done yet? Is this the time for adventures, for slowing down, or just for a change of pace with low financial stress?

The more we look around, the more we will see examples of people taking soft retirement:

- The police officer who “retired” to manage his rentals.

- The banker who decided to spend his time as a movie extra.

- The office worker who started working part time on a small vineyard.

(All true stories!!)

What would you do, if you knew your future was taken care of and you only needed to cover your expenses to live the life of your dreams?

Read More

37 Women and Money Statistics You Need to Know

I Won’t Money: How To Be Able to Say No to Your Employer

Long Term Financial Goals: Step-by-Step Guide to Success

Reduce Fixed Costs and Afford Indulgent Everyday Luxury

This is such a great post! I am exploring taking a short term break or continuing working a little longer so I can ease into a soft retirement. I have been pretty burned out recently and need to make a change of some sort! Thanks for sharing the math behind this idea!